|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 30 Yr Fixed Rates Today: A Complete Beginner's GuideIntroduction to 30 Year Fixed Mortgage RatesThe 30-year fixed-rate mortgage is one of the most popular home loan options available today. It offers consistent monthly payments, which can help with budgeting and financial planning over the long term. Factors Affecting Today's 30-Year Fixed RatesEconomic IndicatorsInterest rates are influenced by various economic indicators including inflation, employment rates, and the Federal Reserve's policies. Keeping an eye on these factors can help predict future rate changes. Credit ScoreYour credit score plays a crucial role in determining the interest rate you are offered. A higher score generally means a lower rate, potentially saving you thousands over the life of your loan.

For detailed calculations on potential savings, you might find tools like a condo refinance calculator helpful. Advantages of a 30-Year Fixed MortgageChoosing a 30-year fixed-rate mortgage offers several benefits:

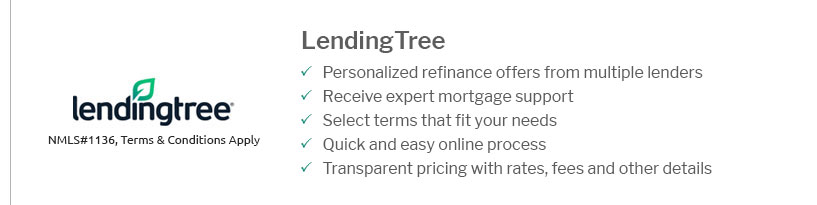

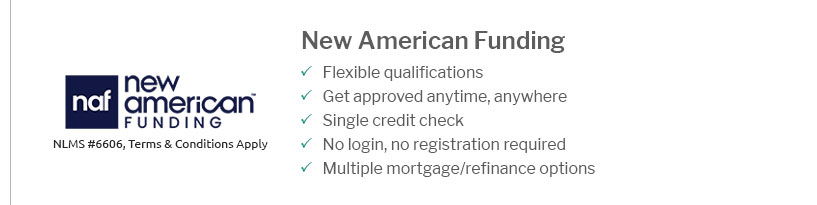

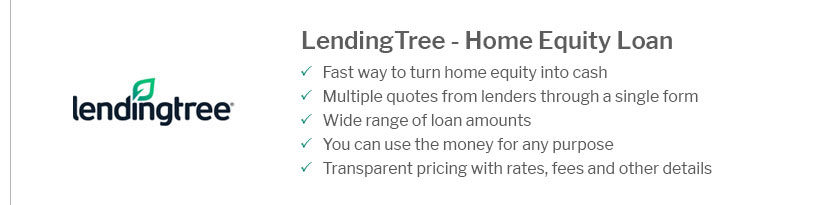

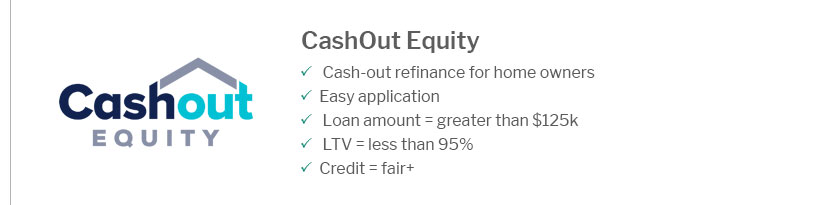

Comparing Lenders for the Best RatesNot all lenders offer the same rates, so it's important to compare different institutions. A tool from a home loan small finance bank can provide personalized rate comparisons. FAQ: Common Questions About 30-Year Fixed RatesWhat is a 30-year fixed-rate mortgage?A 30-year fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of 30 years. This ensures that your monthly principal and interest payments remain the same throughout the loan period. How often do 30-year fixed rates change?While your specific rate remains fixed once your loan is finalized, the rates offered by lenders fluctuate daily based on market conditions. It's advisable to lock in a rate when you find one that meets your financial goals. Can I refinance my 30-year fixed-rate mortgage?Yes, refinancing is an option if you want to lower your interest rate, reduce your monthly payment, or change your loan term. It's important to consider closing costs and the break-even point when refinancing. https://www.nerdwallet.com/mortgages/mortgage-rates

At 4.25%, the monthly principal and interest cost $1,229.85. So, for a $250,000 mortgage with a 30-year term, cutting the interest rate from 4.25% to 4% saves ... https://www.usbank.com/home-loans/mortgage/conventional-fixed-rate-mortgages/30-year-fixed-mortgage-rates.html

A 30-year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the ... https://ycharts.com/indicators/30_year_mortgage_rate

30 Year Mortgage Rate is at 6.65%, compared to 6.67% last week and 6.87% last year. This is lower than the long term average of 7.71%. The 30 Year Mortgage ...

|

|---|